Microsoft Corporation Nível visado: 231.2309

Canal ascendente identificado em 08-jun-2021 15:00 EDT. Este padrão está ainda em processo de formação. Possível previsão de movimento em baixa para o nível de 231.2309 no próximo 2 dias.

US Tech 100 Index Nível visado: 13865.8000

Cunha ascendente identificado em 08-jun-2021 07:00 EDT. Este padrão está ainda em processo de formação. Possível previsão de movimento em alta para o nível de 13865.8000 no próximo 15 horas.

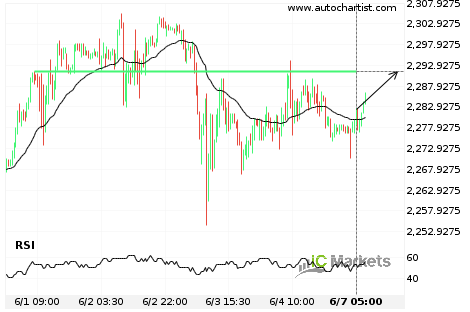

US Small Cap 2000 Index Nível visado: 2291.4800

Aproximando-Resistência nível de 2291.4800 identificado em 07-jun-2021 05:00 EDT

Biogen Idec Inc Nível visado: 282.9700

Aproximando-Resistência nível de 282.9700 identificado em 03-jun-2021 19:30 EDT

Apple Inc. Nível visado: 116.7944

Triângulo identificado em 03-jun-2021 07:15 EDT. Este padrão está ainda em processo de formação. Possível previsão de movimento em baixa para o nível de 116.7944 no próximo 17 horas.

US Tech 100 Index Nível visado: 13682.5393

Triângulo quebrou na linha de resistência em 02-jun-2021 06:00 EDT. Possível previsão de movimento em alta nos próximos 6 horas para 13682.5393

US Small Cap 2000 Index Nível visado: 2287.8700

Cunha ascendente identificado em 01-jun-2021 05:00 EDT. Este padrão está ainda em processo de formação. Possível previsão de movimento em alta para o nível de 2287.8700 no próximo 3 dias.

Microsoft Corporation Nível visado: 228.6362

Triângulo identificado em 28-mai-2021 20:00 EDT. Este padrão está ainda em processo de formação. Possível previsão de movimento em baixa para o nível de 228.6362 no próximo 2 dias.

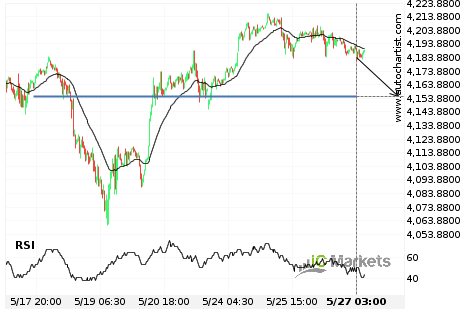

US SPX 500 Index Nível visado: 4216.1000

Cunha ascendente identificado em 27-mai-2021 13:00 EDT. Este padrão está ainda em processo de formação. Possível previsão de movimento em alta para o nível de 4216.1000 no próximo 2 dias.

US SPX 500 Index Nível visado: 4155.1001

Aproximando-Apoiar nível de 4155.1001 identificado em 27-mai-2021 03:00 EDT